In my previous post, I explained how to register for the PNB ONE mobile banking service online. In this post, I’ll guide you on how to activate the PNB ONE Mobile Banking App. As we know, Punjab National Bank is the most popular bank in India and ranks as the third-largest bank in India and 248th in the world in terms of assets. PNB provides excellent features and security in online internet banking, mobile banking, SMS banking, and mobile app banking, and their banking support is also commendable.

PNB also offers the PNB ONE mBanking Android app, allowing you to easily check balances, conduct transactions, transfer money worldwide, make bill payments, and much more. If you have already registered and activated the mobile banking service with your Account User ID, you can easily activate the PNB ONE Mobile Banking App. If not, then first register for the mobile banking service.

How to Register for Mobile Banking Facility?

You can register for the mobile banking service in two ways:

- Through your bank branch.

- Online.

How to Activate PNB ONE Mobile Banking App (Android)?

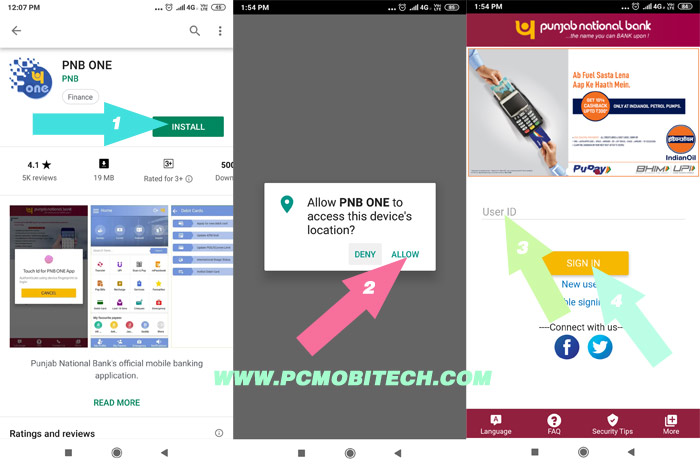

Once registered, download and install the PNB ONE app From: here

- Open the PNB ONE Mobile Banking app on your Android smartphone. It will prompt you to allow the device’s location, so tap on the ALLOW button.

- If you have already registered for mobile banking service with your account User ID, enter your User ID (e.g., AGG001111) in the box and tap on the SIGN IN button.

- Next, you will see the Set MPIN screen, and an OTP message will be sent to your bank-registered mobile number. Enter the 6-digit code number received in the OTP message at the Set MPIN screen and tap on the CONTINUE button.

- On the next screen, create a new MPIN code for your PNB ONE mobile banking application. This code will serve as your password; you’ll need to enter it whenever you want to log in to your account. Create a 4-digit PIN, enter it again in the Confirm MPIN box, and then tap on the Submit button.

- Now, your Punjab National Bank (PNB) mobile banking app has been successfully activated. Tap on the SIGN IN button and enter the MPIN you created recently.

That’s it! Now, enjoy the PNB ONE mobile banking app on your Android smartphone.

For any problems or suggestions, please leave a message in the comment box.

When you purchase through links on our site, we may earn an affiliate commission. Read our Affiliate Policy.