As we know, slowly we are transitioning to a cashless payment system. Cashless payment means we don’t need to carry cash in hand and can pay our expenses via digital money. The government is also encouraging digital payments using E-Payments, debit and credit cards, net banking, and digital wallet apps. To make digital payments easy, many banks offer their own digital wallet apps, such as ICICI Bank’s Pockets and SBI’s State Bank Buddy. However, when it comes to popularity, many third-party digital wallet apps are available, with PayTm being the first choice for many.

PayTm is a major digital wallet app and is the most popular in India. With the PayTm wallet, you can make hassle-free online expenses/shopping, pay your mobile, data card, landline/broadband, electricity, DTH, water, gas, metro, insurance bills, and book bus tickets, hotels, train tickets, amusement parks, events, movie tickets, and flight tickets. PayTm also allows you to shop online and at small or big shops.

Before using the PayTm Wallet app, you need to activate (register) your PayTm account and add funds to it. Here’s how to activate and add funds to the wallet using a credit/debit card:

Activate/Register PayTm Digital Wallet

If you have recently installed the PayTm app and are looking to activate it but don’t know how to register and activate a PayTm account and the app, follow the steps below:

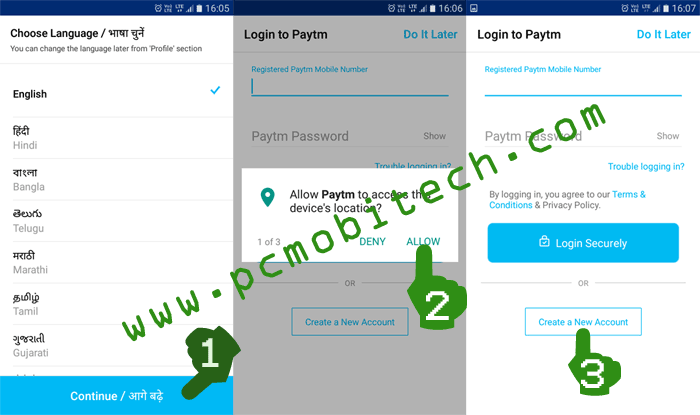

- Start the PayTm app on your Android or iPhone and choose your preferred language, then tap on the “Continue” button.

- Next, allow the three permissions: Location, Manage Phone Calls, SMS permissions (if you don’t want to give permission, simply tap on “Deny,” but you will need to manually verify the received OTP in the PayTm app).

- Now, the Paytm login page will appear. If you already have a Paytm account, you can log in by entering the mobile number and password. In case you don’t have an account, tap on the “Create a New Account” button.

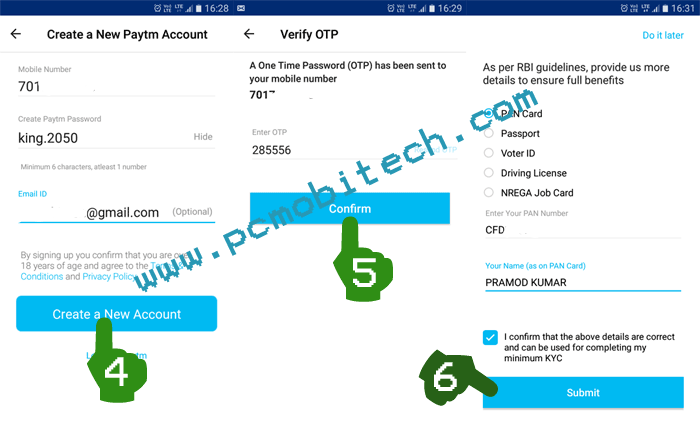

After tapping on the “Create a New Account” button, you will need to enter the following information:

Mobile Number: Enter a working mobile number. You’ll need to verify this mobile number, so keep the phone in your hand because you’ll receive an OTP on this number. Please note, use only the original mobile number, as Paytm regularly sends billing and other information to this number. Avoid using temporary phone numbers for verification.

Password: Create a strong password, including both lowercase and uppercase letters (AbCDe), numbers (123456789), and special characters (.#@%&), e.g., MyWoRld123. Also, write this password on paper and keep it in a safe place. This will help you when you forget it.

Email ID: Enter a working email ID. This will help you receive important updates on Paytm transactions and news. This is optional; if you prefer not to share your email ID, leave it empty.

- After entering the correct information, tap on the “Create a New Account” button. If the entered mobile number is correct, you will receive an OTP message immediately on your number. If you have allowed the permission, it will automatically select the OTP; otherwise, you will have to enter it manually. After that, tap on the “Confirm” button.

- Next, you’ll have to verify your ID because, under new RBI rules, you cannot use a payment wallet with full strength (adding funds to the Paytm app) until you complete KYC. If you want to add funds to the wallet, it is essential to verify your identity with a document proof. If you don’t want to verify your ID immediately, tap on the “Do it later” link at the top right. For verification, select any ID type, enter the ID number, tick the confirmation checkbox, and tap on the “Submit” button.

- That’s it! Now you have successfully created a Paytm account and activated the Paytm Wallet app. You can start adding funds if you have completed the KYC form.

Complete Profile Information

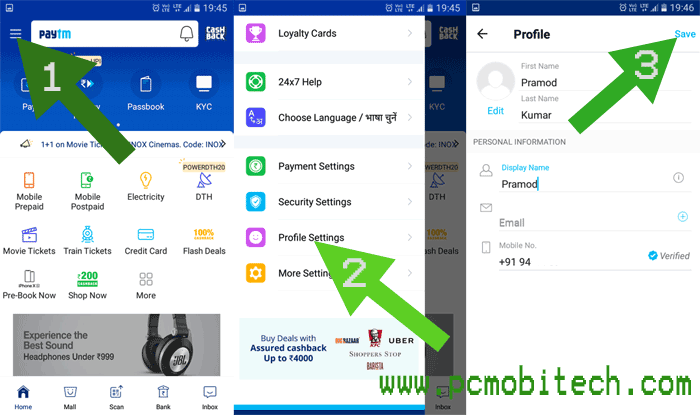

After activating the Paytm wallet app, it’s important to complete your profile information. Follow these steps:

- Tap on the top-left menu button and choose the “Profile Settings” option.

- In the profile, enter your first name, last name, display name, and email (optional).

- Tap on the top-right “Save” button.

- You will see a message stating, “Your profile information has been updated successfully.”

How to Add fund to PayTm Digital Wallet?

Before adding funds to the Paytm wallet, you’ll need to complete your KYC information. Verify your ID, and only then can you add funds to the Paytm Wallet. If you have finished your KYC form during the Paytm activation process, you can proceed and add funds to your Paytm wallet with the following steps:

- If your KYC has been completed, you’ll start seeing an “Add Money” icon on the home screen of the app. If it is available, tap on this.

- On the next screen, enter the amount that you want to add to the wallet and tap on the “Add Money” button.

- An important message box will appear; tick the checkbox “I understand” and tap on the Confirm button.

- Next, the “Complete Your Payment” screen will open, where you’ll have four options: BHIM UPI, Debit Card, Credit Card, and Net Banking. Select any method you prefer and tap on the “Pay Now” button. For example, I’m going to add funds via Debit Card:

Card No: Enter your Debit card number available on the front side.

Month & Year: Select your Card Expiry month & year.

CVV: Enter the 3-digit CVV code printed on the back of the card.

Save this card for future checkout: Check this checkbox if you want to save this card in the PayTm app for faster payments.

Pay now: Tap on the “Pay now” button to make payment to the Paytm Wallet.

- Now, wait for a few moments, and the page will be redirected to your bank card verification page. On the bank card verification page, you’ll need to enter OTP (One Time Password), which will be sent by the bank to your registered mobile number. So check the SMS OTP (message) on your bank-registered mobile number and fill in the 6-digit OTP code in the PayTM app. In case you have enabled a 3D secure PIN on your card, you’ll see your Bank 3D secure PIN password verification page, and you need to enter the 3 Secure PIN. After filling OTP or 3D secure PIN, tap on the “Submit” button.

- After submission, the page will be redirected to the PayTm Order Summary page, and you’ll see a success message of Rs. 1 PayTM cash. You’ll also receive a debit card transaction SMS on your registered mobile number and a transaction email from PayTm. The card will be saved in PayTm for future transactions.

- You have successfully added Rs. 1 fund to your PayTm wallet. Now, when you need to add more funds, tap on the “Add Money” option on the PayTm home screen, fill in the necessary amount, and tap on the “Add Money” button. Follow the same steps as described above.

If you encounter any problems related to the topic, please leave a reply.

When you purchase through links on our site, we may earn an affiliate commission. Read our Affiliate Policy.

Pramod, thanks for teaching me how to activate Paytm app and add fund to Paytm wallet.

Money is not coming to my paytm wallet, what to do sir?

my pytm wallet is not active please help me

I am not able to add money in paytm through debit card after kyc verification and 100 mobile recharge.pl tell the procedure.

Says my mobile number isnt valid apon sign up but it is and i use it everyday

If you already signed up previously, then you don’t need to signup again. Just use Forgot Password link.

while activating paytm wallet its getting- you have exceeded maximum number of verification..try after 24 hours..since yday..what can i do now?

My Paytm app is not activating.

What error you’re getting? If Paytm service is already activated previously then you will need to reset it or you can use Forgot password option.

Kya koi paytm add money ka offer hai

No, They don’t provide any offer when you add money to Paytm.

While adding money to Paytm wallet it is asking for Paytm otp but it is not sent.. please help

When you go to add money to PayTm Wallet, PayTm will not ask any OTP confirmation. It may be bank which want to confirm that it is doing by account holder. So first check your Bank Registered mobile number. And if it is asked by Paytm then double check your Paytm registered mobile number.